Biosimilars aren’t generics. That’s the first thing to understand. Generics copy simple chemical drugs - pills you swallow. Biosimilars copy complex biologic drugs - living-cell-based treatments made in bioreactors, often injected or infused. These are drugs for cancer, rheumatoid arthritis, diabetes, and other serious conditions. And while they cost far less than the original biologics, their path to market is anything but simple. Europe and the United States took wildly different roads to get here - and now, they’re on a collision course.

Europe Was First - and It Stayed Ahead

Europe didn’t just lead the biosimilar race. It built the entire track. In 2006, the European Medicines Agency (EMA) approved Omnitrope, the world’s first biosimilar. That wasn’t an accident. The EMA had already laid out a clear, science-based framework for approval: prove similarity through detailed lab tests, animal studies, and limited human trials. No need for massive, expensive phase III trials comparing every single patient outcome. Just show the molecule behaves the same way - and it’s approved.

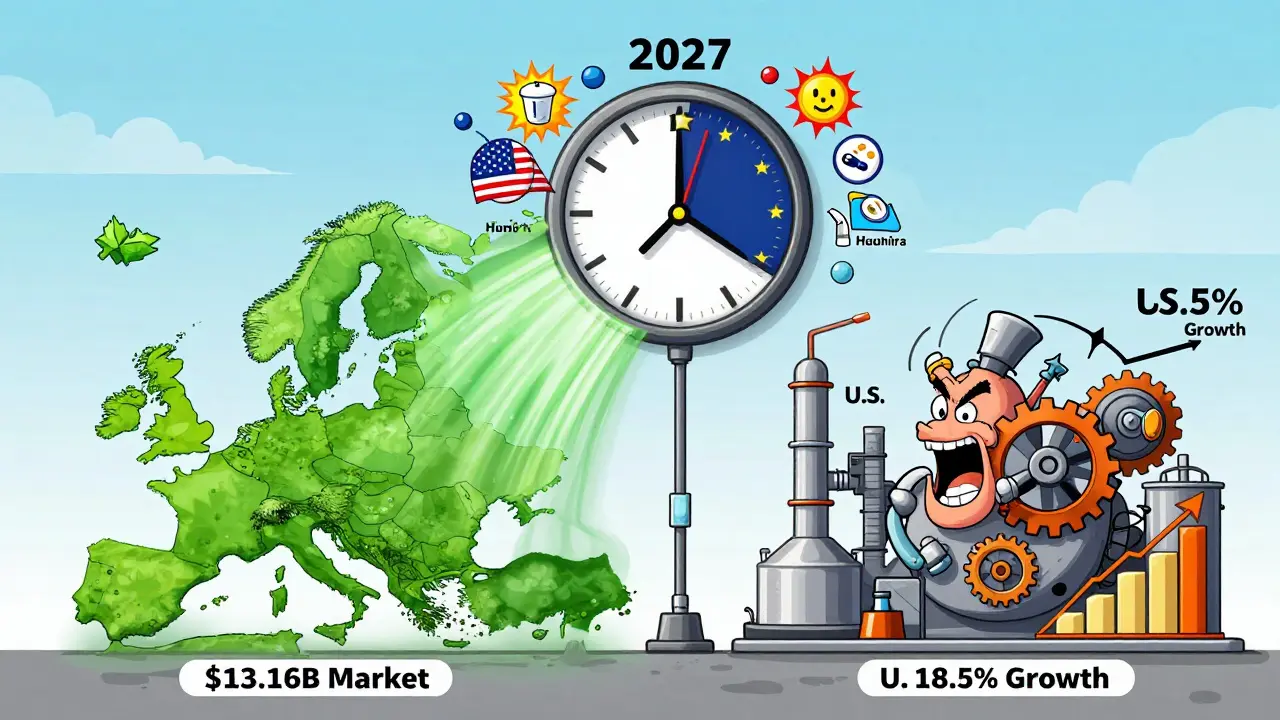

That clarity changed everything. Hospitals in Germany, France, and the UK started using biosimilars in bulk. Tenders favored lower-cost options. Doctors trusted the data. Patients didn’t resist. By 2024, Europe’s biosimilar market hit $13.16 billion. In some countries, over 80% of patients with autoimmune diseases like rheumatoid arthritis are now treated with biosimilars instead of the original biologic. Sandoz, Fresenius Kabi, and Amgen became household names in European hospitals. Germany, in particular, turned into a manufacturing hub - not just using biosimilars, but making them for the whole world.

The United States Took a Detour

The U.S. didn’t approve its first biosimilar until 2015 - nine years after Europe. Why? Because the system was broken from the start. The Biologics Price Competition and Innovation Act (BPCIA) of 2009 was supposed to create a path for biosimilars. But it came with a minefield: patent lawsuits, legal battles called the “patent dance,” and a regulatory bar so high that few could clear it.

The FDA demanded more clinical data than Europe. It insisted on switching studies - proving that patients could safely jump from the original drug to the biosimilar and back again. That wasn’t just expensive. It was unnecessary. No one was asking for switching studies for generics. But for biosimilars, the FDA said yes. And originator companies? They fought back. With deep pockets and long patent portfolios, they delayed market entry for years. By 2024, the U.S. had approved only about 20 biosimilars. Europe had approved over 100.

And it showed in the numbers. While Europe’s market grew steadily at 13% a year, the U.S. lagged. Even though the U.S. has a much larger biologics market - with drugs like Humira bringing in billions - adoption was slow. Only six of the 14 approved Humira biosimilars were actually on the market in 2024. The rest were stuck in legal limbo.

The Turning Point: FDA Changes in 2024

Everything changed in June 2024. The FDA dropped the requirement for switching studies to gain “interchangeable” status. That’s huge. Interchangeable means a pharmacist can swap the biosimilar for the brand-name drug without asking the doctor. In Europe, that’s standard. In the U.S., it was nearly impossible.

That single change unlocked the door. Suddenly, biosimilar makers could get to market faster and cheaper. Pfizer, Merck, and Samsung Bioepis started pushing new products. The Inflation Reduction Act of 2022 helped too - by closing the Medicare Part D coverage gap, it made biosimilars more attractive to insurers. Now, the U.S. market is growing at 18.5% a year. By 2033, it could hit $30.2 billion. Europe’s growth is slower - around 17.3% - but still strong.

Why the U.S. Might Soon Outpace Europe

Europe has a head start. But the U.S. has something Europe doesn’t: a tidal wave of expiring patents. Between 2025 and 2034, 118 biologic drugs will lose patent protection. That’s a $232 billion opportunity. Humira is just the beginning. Drugs for psoriasis, Crohn’s disease, and type 2 diabetes are next. And with the FDA now aligned more closely with EMA’s science-first approach, U.S. companies are moving fast.

North America is projected to overtake Europe in market size by 2027. Why? Because the U.S. market is catching up - and it’s bigger. Europe’s growth is steady. The U.S. is accelerating. The U.S. also has more private payers and pharmacy benefit managers (PBMs) pushing for cost savings. Once biosimilars hit formularies, adoption spikes.

Therapeutic Areas: Where Each Region Leads

Europe’s strength? Autoimmune diseases. Biosimilars for adalimumab, infliximab, and etanercept dominate. In Germany, over 90% of new patients get biosimilars for rheumatoid arthritis. In the U.S., adoption started with supportive care - drugs like filgrastim for low white blood cell counts after chemotherapy. Those are simpler biologics. Now, the U.S. is moving into the same complex areas as Europe: monoclonal antibodies for cancer and autoimmune disorders.

The difference? Europe’s doctors have 18 years of experience. U.S. doctors are learning fast. Patient education is catching up. More hospitals are training staff. More insurers are covering biosimilars without restrictions. The gap is closing.

Manufacturing and Supply Chain

Europe still leads in manufacturing. Germany, Ireland, and Sweden host major biosimilar production sites. Companies like Sandoz and Fresenius Kabi have built decades of expertise. The U.S. is playing catch-up. But with new FDA rules and massive investment from Pfizer and Merck, U.S.-based manufacturing is rising. Samsung Bioepis, a South Korean company, already produces biosimilars for both markets - showing how global the supply chain has become.

What’s Next? Cost Savings and Patient Access

Biosimilars aren’t just cheaper. They’re life-changing. A single biologic for rheumatoid arthritis can cost $20,000 a year. The biosimilar? $12,000. That’s a 40% drop. Multiply that across millions of patients, and you’re talking billions saved. In Europe, that’s already happening. In the U.S., it’s just starting.

The next challenge? Making sure patients get these drugs - not just hospitals. Insurance formularies still favor brand-name drugs in many cases. Doctors still default to the original because they’re unfamiliar with biosimilars. But with more approvals, more data, and more payer incentives, that’s changing.

The global biosimilar market will hit $176 billion by 2034. Europe and the U.S. will drive most of that growth. Europe won the first leg of the race. The U.S. is winning the sprint now.

What This Means for Patients

If you’re on a biologic drug - whether it’s for diabetes, cancer, or an autoimmune disease - biosimilars are coming. And they’re safe. The science is solid. The regulatory standards are tight. The only question is: when will your doctor offer you one?

Don’t assume your treatment won’t change. Ask. If you’re in the U.S., ask about interchangeable biosimilars. If you’re in Europe, ask if your current treatment is a biosimilar. Either way, you’re not just getting a cheaper drug. You’re getting the same medicine - at a price your wallet can handle.

Are biosimilars the same as generics?

No. Generics are exact copies of simple chemical drugs, like aspirin or metformin. Biosimilars are highly similar to complex biologic drugs made from living cells - like those used for cancer or arthritis. They’re not identical, but they work the same way and have no meaningful difference in safety or effectiveness. The manufacturing process is far more complex than for generics.

Why did Europe adopt biosimilars faster than the U.S.?

Europe created a clear, science-based regulatory path early on - the EMA approved biosimilars with less clinical data and encouraged hospital procurement systems to favor lower-cost options. The U.S. had a fragmented system with patent lawsuits, legal barriers, and stricter FDA requirements like mandatory switching studies. Europe built trust; the U.S. built roadblocks.

What changed in the U.S. in 2024 to speed up biosimilar adoption?

In June 2024, the FDA removed the requirement for switching studies to get “interchangeable” status. That means pharmacists can substitute biosimilars for brand-name biologics without asking the doctor - just like generics. This cut approval time and costs, making it easier for companies to launch products. It’s the biggest regulatory shift since the BPCIA passed in 2009.

Which countries in Europe lead in biosimilar use?

Germany, France, and the United Kingdom lead in adoption. Germany is also the top manufacturing hub, producing biosimilars for global markets. These countries use hospital tenders and mandatory substitution policies to drive uptake, especially in oncology and rheumatology. As a result, biosimilars make up over 80% of new prescriptions in some therapeutic areas.

Will biosimilars replace brand-name biologics completely?

Not completely - but they’ll dominate. In Europe, biosimilars already capture most new prescriptions for drugs like adalimumab. In the U.S., adoption is rising fast. Brand-name drugs will still be used in cases where patients respond better to the original, or when insurance doesn’t cover the biosimilar. But cost pressure, regulatory support, and physician confidence are pushing biosimilars to become the default choice.

How much cheaper are biosimilars than the original biologics?

Biosimilars typically launch at a 15% to 30% discount compared to the reference biologic. In some cases, after competition increases, prices drop by 50% or more. For example, a Humira biosimilar might cost $12,000 a year instead of $20,000. That’s not just savings for insurers - it’s access for patients who couldn’t afford the original.

Comments (14)

Anu radha

December 17, 2025 AT 02:58Biosimilars are cheap and work good. My cousin use it for arthritis and save so much money.

Joe Bartlett

December 17, 2025 AT 17:04Europe did it right. Simple, smart, no drama. The US? Always overcomplicating everything.

Sachin Bhorde

December 17, 2025 AT 20:55Yo, the FDA’s old rules were pure nonsense. Switching studies? That’s like requiring you to test if two different brands of aspirin are ‘interchangeable’ before letting pharmacists swap them. Biosimilars aren’t generics, sure - but they’re not magic either. The science’s solid. Sandoz and Samsung Bioepis are making them in bulk, and the data’s been peer-reviewed for a decade. The US was just scared of losing Big Pharma cash flow. Now that the FDA’s finally chillin’, we’re gonna see a flood of biosimilars hitting shelves. And honestly? Patients are gonna thank us.

Steven Lavoie

December 18, 2025 AT 01:31It’s fascinating how regulatory philosophy shaped outcomes. Europe treated biosimilars as a public health imperative - streamline approval, incentivize procurement, build trust. The U.S. treated them like legal landmines. The BPCIA was a well-intentioned mess: too many loopholes, too many patent trolls. Now, with the 2024 FDA shift, we’re finally catching up to the science - not the lawsuits. The real win? Patients aren’t just getting cheaper drugs. They’re getting access. And that’s what medicine is supposed to be about.

Radhika M

December 19, 2025 AT 01:14My brother in Delhi got his biosimilar for diabetes last year. Cost was half. He’s doing great. No side effects. Why is this not common knowledge here?

Linda Caldwell

December 19, 2025 AT 17:39This is the kind of change that actually matters. No hype. No buzzwords. Just better science and lower prices. We’re talking about people who can’t afford $20K/year for insulin or Humira. This isn’t corporate math - it’s life or death. And now the U.S. is finally moving. Slow? Maybe. But moving. Let’s keep pushing.

Evelyn Vélez Mejía

December 19, 2025 AT 21:59The biosimilar divide between Europe and the U.S. isn’t just about regulation - it’s about cultural values. Europe sees healthcare as a collective good. The U.S. sees it as a market to be optimized for profit. The EMA didn’t wait for lawsuits to clear; they trusted data. The FDA, entangled in litigation and lobbying, turned science into a courtroom drama. Now, with the 2024 shift, we’re witnessing a quiet revolution - not in labs, but in the architecture of trust. When a pharmacist can swap a drug without a doctor’s signature, you’re not just changing a prescription. You’re changing the social contract of care.

Kent Peterson

December 21, 2025 AT 13:13Wait - so now the FDA says biosimilars are ‘interchangeable’? That’s a joke. Who’s to say they don’t cause long-term immune reactions? The original biologics have 20 years of safety data. These ‘similar’ drugs? Five at most. And don’t even get me started on how Pfizer and Merck are just repackaging old molecules and calling them ‘innovative.’ This is corporate greed dressed up as progress. And now you want me to trust a pharmacist to swap my drug? No thanks.

Jigar shah

December 22, 2025 AT 17:37Interesting. So Europe’s model was bottom-up - hospitals and doctors drove adoption. The U.S. was top-down - regulators and lawyers controlled it. Now that the FDA is aligning with EMA, maybe the U.S. can learn from Europe’s real-world experience. But will the payer systems actually reimburse properly? That’s the next hurdle.

Philippa Skiadopoulou

December 23, 2025 AT 20:24The regulatory divergence was always a matter of institutional culture. The EMA prioritized efficiency and evidence. The FDA prioritized caution and litigation. The 2024 change is not a reversal - it’s a correction. The science has not changed. The bureaucracy has.

Marie Mee

December 25, 2025 AT 02:50Big Pharma is lying to us. Biosimilars are just a trick to make us sick again. They’re using cheaper ingredients. They’re testing on poor people in India. You think the FDA really knows what’s in them? They’re just signing papers because they got paid. I read a guy on TruthSocial who said his cousin died after switching. They’re covering it up. The government wants you dependent on cheap drugs so you don’t notice the real problem - the vaccines. Biosimilars are just the first step.

Victoria Rogers

December 25, 2025 AT 11:27U.S. is catching up? Please. Europe’s been doing this for 18 years and still only has 80% adoption. We’re just starting. And who’s gonna pay for all these new biosimilars? PBMs are already squeezing pharmacies. This isn’t progress - it’s another way for insurers to cut corners. And don’t tell me about cost savings. My deductible went up 30% last year. Biosimilars just mean my co-pay will be $0 because they’re forcing me to use them. That’s not access. That’s coercion.

Pawan Chaudhary

December 26, 2025 AT 11:10Love this! Biosimilars are the future. Everyone deserves affordable medicine. India and the U.S. both need to get on board. Keep pushing!

Josh Potter

December 27, 2025 AT 00:41Bro. Europe had 18 years. We had lawsuits. Now we’re rolling. Pfizer’s got 5 new biosimilars coming this year. Merck’s not sleeping. And guess what? Hospitals are already switching. My aunt got her Humira biosimilar last month - same results, half the cost. This isn’t some corporate scam. It’s medicine catching up with reality. Stop overthinking it. Just be glad you’re not paying $20K for a shot anymore.